PAN - Permanent Account Number (PAN).

We are registered as TIN Facilitating Centre with PROTEAN eGOV TECHNOLOGIES LIMITED (formerly known as NSDL eGovernance Infrastructure Limited), acting as an Intermediary between PROTEAN & Individuals. And the applications forms can be downloaded from our website www.ananthaassociates.co.in Please fill in the forms and send it to us. We shall process the same and obtain your PAN hassle free. We render assistance in the following areas.

For Individuals:

- Applying for PAN

- Change in PAN data/Duplicate PAN Card

For Corporates:

- Permanent Account Number (PAN)

- Tax Deduction and Collection Account Number (TAN)

- e-TDS and e-TCS

- Annual Information Return (AIR)

The process:

- Assist in filling up the application forms for new PAN card

- After internal processing, we forward the application details to NSDL

- We also help you for effecting changes/correction in PAN

Instructions:

Clearly mention your email id as well as the phone number in the application as the soft copy of the Pan card will also be sent in addition to the hard copy. Your phone number will help in case of any discrepancies that need to be corrected in the application form.

Tracking your application:

The applicants may track the status of their application after three days by:

- Using the 15 digit unique acknowledgment number.

- Calling TIN Call Centre on 020 – 2721 8080.

- Sending an SMS - NSDLPAN < your 15 digit acknowledgement number> to 57575.

Normally 15 days is required to process the application (provided the application form is in order).

TAN - Tax Deduction and Collection Account Number (TAN).

TAN applications and we are registered with PROTEAN eGov Technologies Limited (Formerly Known as NSDL eGovernance Infrastructure Limited) as TIN facilitation centre and authorized partners for processing TAN application forms. We can partner with you in obtaining TAN (Tax deduction and collection account number), which is a mandatory requirement for tax deduction. The application forms can be downloaded from our website www.ananthaassociates.co.in Please fill in the forms and send it to us. We shall process the same and obtain your TAN hassle free.

Status Track:

The applicants may track the status of their application after three days by:

- Using the 14 digit unique acknowledgment number.

- Calling TIN Call Centre on 020 – 2721 8080.

- Sending an SMS - NSDLTAN < your 14 digit acknowledgement number> to 575

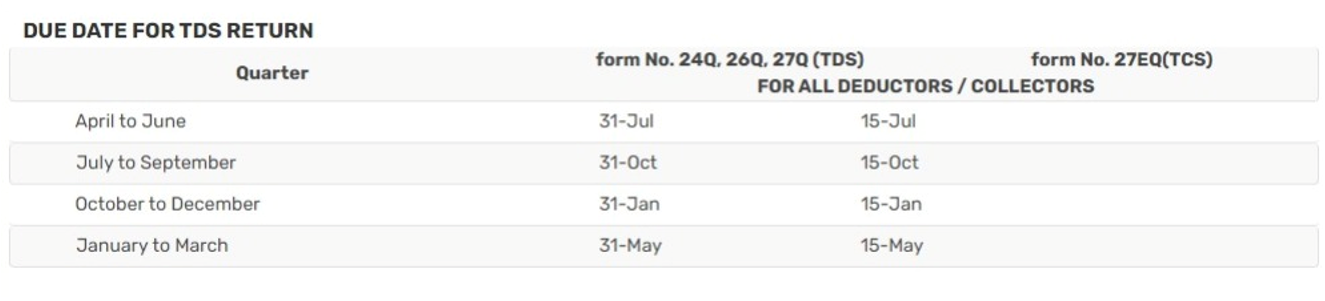

e-TDS/TCS - e-Tax Deducted at Source (e-TDS) / e-Tax Collected at Source (e-TCS)

TIN facilitation centers approved by PROTEAN eGov Technologies Limited (Formerly known as NSDL eGovernance Infrastructure Limited) to facilitate deductors/collectors to file their e-TDS/e-TCS returns. We offer expert level guidance in the e-filing of TDS/TCS returns. We offer expert level guidance in the e-filing of TDS/TCS returns.

The process:

The Income Tax department has notified revised file formats for preparation of TDS and TCS returns in electronic form, which the deductors/collectors can prepare and submit in our designated branches.

If the e-TDS/e-TCS return file is complete in all aspects, we will issue a provisional receipt which is deemed to be the proof of e-TDS/e-TCS return filed.

We also undertake electronic data conversion activity to enable the deductors not familiar with the file formats to file the statements electronically within the prescribed time limit.